Watch how Everence member Abe Landes has included planned giving and trusts into his work to help an organization he's passionate about.

Separate plans, each with advantages

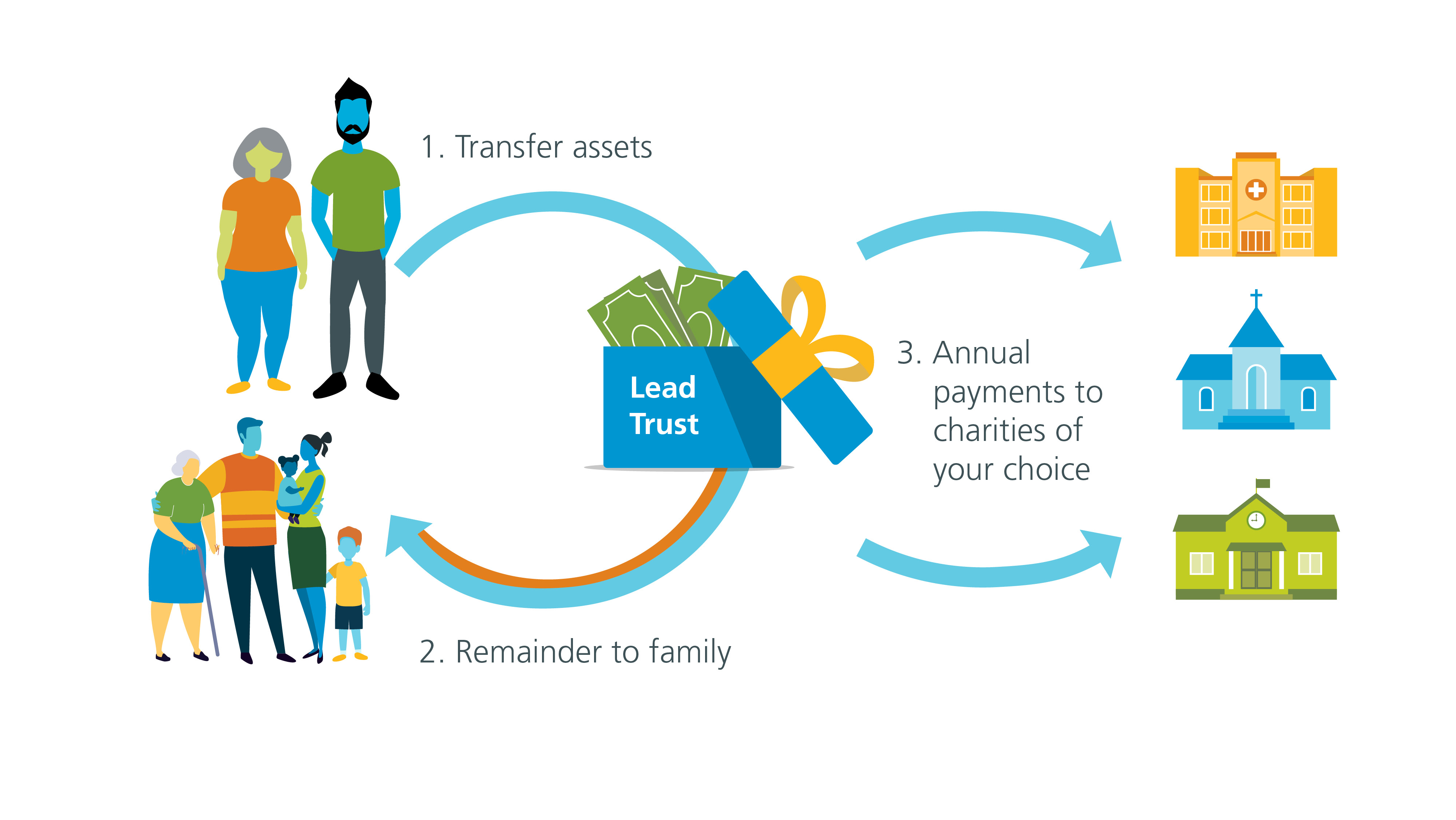

Charitable lead trust

This arrangement provides current income from your gifted assets to one or more charitable organizations for a period of time – but returns the asset to you or your heirs.

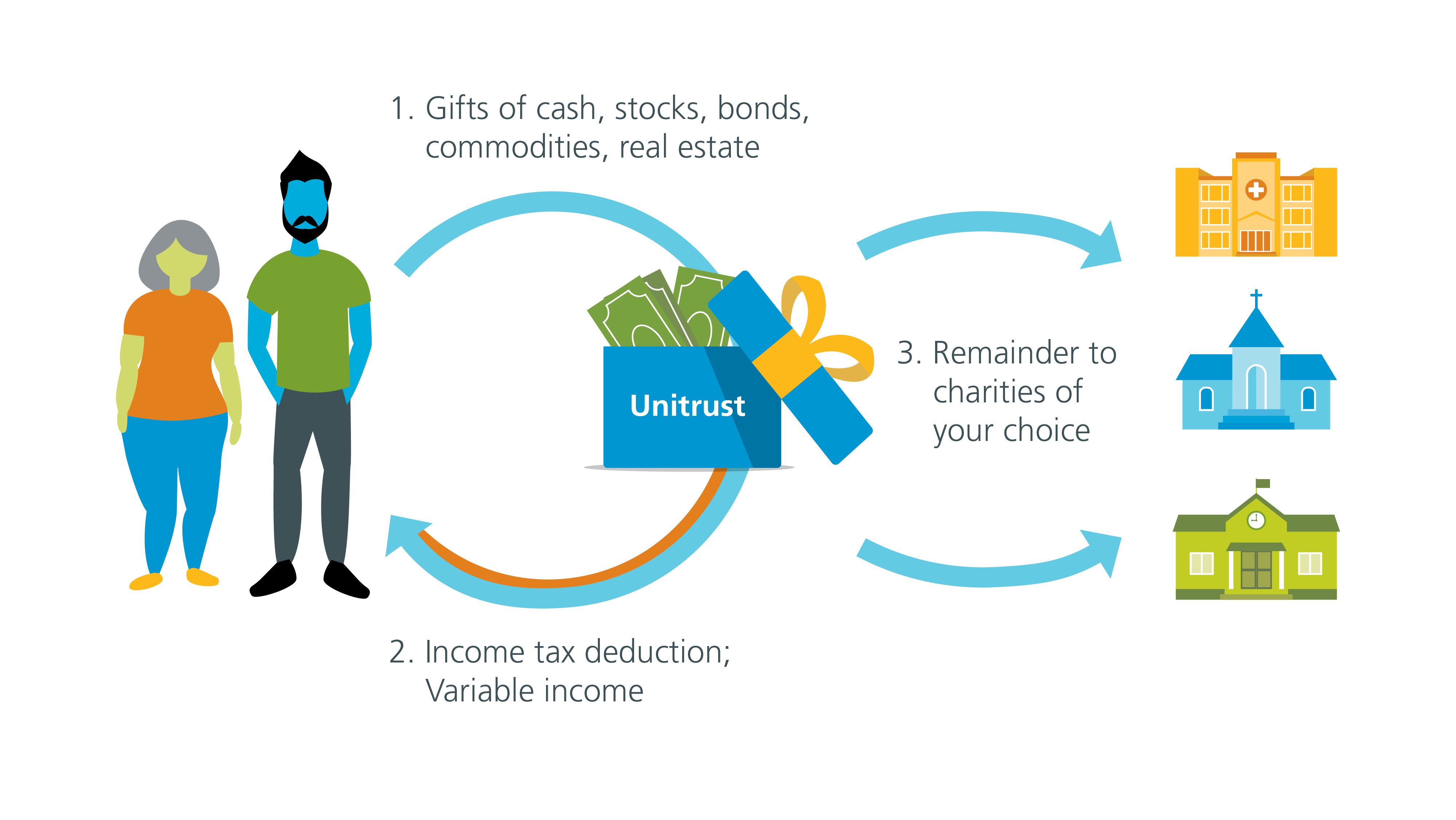

Charitable remainder trust

A gift of real estate or securities is received into a trust, converted to cash and invested. You receive income from the trust – and after you pass away – the remainder goes to one or more charitable organizations.

When you’re dealing with your finances, you have to really feel comfortable or feel that this person is really working for you. And I just feel that 100 percent with Everence.

Abe Landes Everence member

Review your opportunities

Other ways to get started

By mail

Everence Financial Corporate Office

1110 N. Main St., PO Box 483

Goshen, IN 46527

By phone

Phone: (800) 348-7468 or (574) 533-9511

Fax: (574) 533-5264

Hours: Monday - Friday 8 a.m. to 5 p.m. (ET)

In person

Feel free to meet one of our financial representatives in person at an office near you. Find your local Everence office.

Estimate your potential gift scenario

Manage your generosity with our Portfolio Link

Through the Portfolio Link you can review detailed portfolio information including: portfolio summary, current holdings, transaction activity, account summary, investment details, and tax lot listings.

Disclosure

Gift plans administered by Everence Foundation.