Medicare and Health Savings Accounts

Keys to navigating tricky HSA situations for Medicare-entitled individuals

Health Savings Accounts (HSAs) are tax-favored programs that can come with High-Deductible Health Plans (HDHPs) offered by employers. While these can be a great asset for employees during and beyond retirement, they can create some tricky situations for Medicare-entitled individuals. Here’s what you need to know:

The basics

- The IRS states that you cannot contribute to an HSA while entitled to any part of Medicare, including premium-free Part A.

- In the year you become entitled to Medicare, you must prorate the amount you contribute to your HSA funds.

- So, someone who is permitted to make contributions from January-April can contribute 4/12 of the annual limit (see below for contribution limit information).

- When you enroll in Medicare during your Initial Enrollment Period (at age 65), you typically become entitled to Medicare on the first day of your 65th birthday month.

- Both employee and employer contributions must cease.

- These rules apply to the HSA account holder only, not their spouse.

Using an HSA while enrolled in Medicare

- While you can no longer contribute to your HSA once enrolled in Medicare, you can still access the funds for qualified medical expenses.

- For many individuals on Medicare, HSAs are used for:

- Dental, vision, and hearing costs that are not covered under Medicare.

- Reimbursement for Medicare Part B and/or Part D premiums.

- Copays or coinsurances for medications.

- HSA funds cannot be used for Medicare supplement premiums.

Contribution limit information

- The type of HDHP dictates the HSA contribution limit, regardless of if a spouse is on Medicare.

- The 2025 family contribution limit is $8,550.

- The 2025 single contribution limit is $4,300.

- Individuals aged 55 and older can contribute an additional $1,000 catch-up contribution.

- The amount you contribute is more important than when you contribute.

- You cannot simply fully fund your HSA prior to your Medicare entitlement date.

Specific scenarios

An individual in a self-only HDHP enrolling in Medicare at age 65:

- You can contribute to your HSA up until the month you turn 65.

- You must prorate the amount you contribute based on your 65th birthday month.

- Example: If your Medicare becomes effective Oct. 1 (the month you turn 65), you can contribute 9/12 of the annual contribution limit.

- In 2025, that would be $5,300 x 9/12 = $3,975 (includes the $1,000 catch up contribution).

- Example: If your Medicare becomes effective Oct. 1 (the month you turn 65), you can contribute 9/12 of the annual contribution limit.

An individual in a family HDHP enrolling Medicare at age 65:

- You can contribute to your HSA up until the month you turn 65.

- You must prorate the amount you contribute based on your 65th birthday month.

- Example: If your Medicare becomes effective Oct. 1 (the month you turn 65), you can contribute 9/12 of the annual contribution limit.

- In 2025, that would be $9,550 x 9/12 = $7,162.50 (includes the $1,000 catch up contribution).

- Example: If your Medicare becomes effective Oct. 1 (the month you turn 65), you can contribute 9/12 of the annual contribution limit.

An individual in a family HDHP, whose spouse is enrolling in Medicare at age 65:

- You can contribute the full family contribution limit if your spouse remains on the family HDHP.

- If your spouse drops your HDHP when enrolling in Medicare, you must prorate your contribution amounts based on HDHP type.

- Example: If your spouse’s Medicare becomes effective May 1, you can contribute 4/12 of the family contribution limit and 8/12 of the single contribution limit.

- $9,550 x 4/12 = $3,183

- $4,300 x 8/12 = $2,867

- Total allowable contribution = $6,050 (includes the $1,000 catch up contribution)

- Example: If your spouse’s Medicare becomes effective May 1, you can contribute 4/12 of the family contribution limit and 8/12 of the single contribution limit.

Enrolling in Medicare past age 65

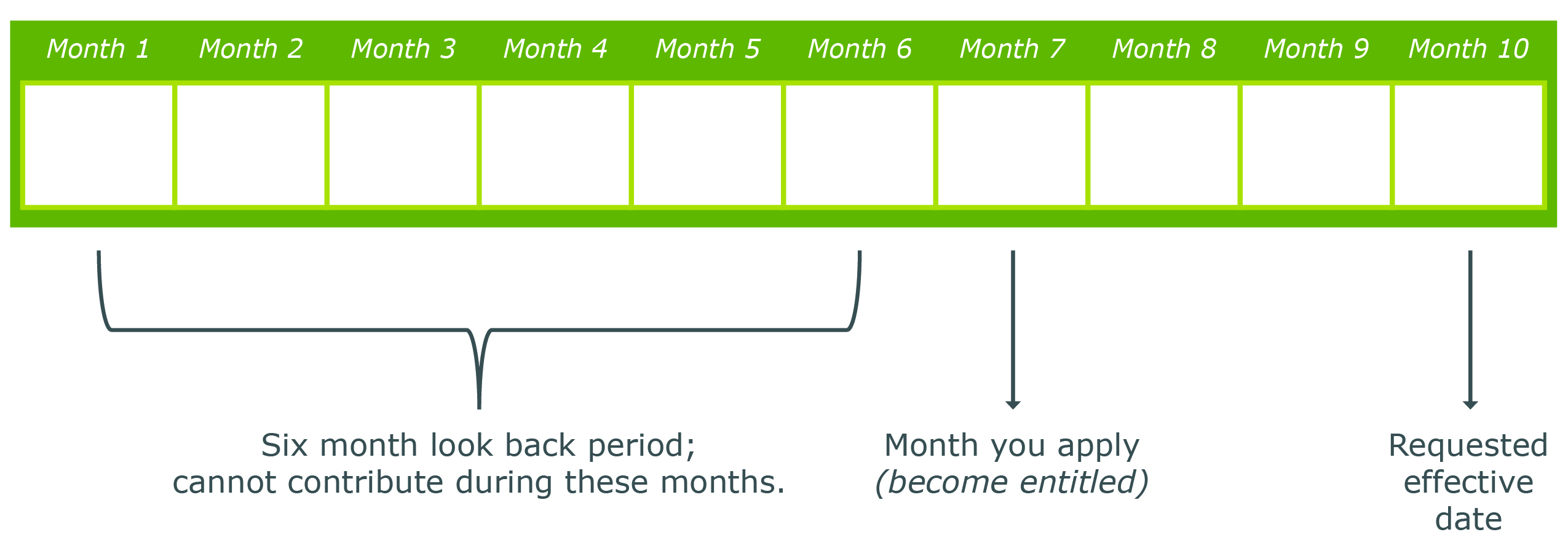

- When enrolling in Medicare past age 65, Medicare Part A can be backdated up to six months. The amount you contribute to your HSA must be based on this backdated Part A date.

- When you are over age 65, you become entitled to Medicare the month you apply for Medicare.

- Best practice is to apply for Medicare at least three months prior to your requested effective date.

Individuals/spouses enrolling after age 65:

- All the scenarios stay the same, but your date of entitlement is based on the month you apply for benefits.

- You must also include the six-month lookback.

- Use the chart below to determine how to prorate your HSA contributions.