Find the best Medicare option for your life

Educating yourself today can benefit you greatly in the future.

Health and wellness

|

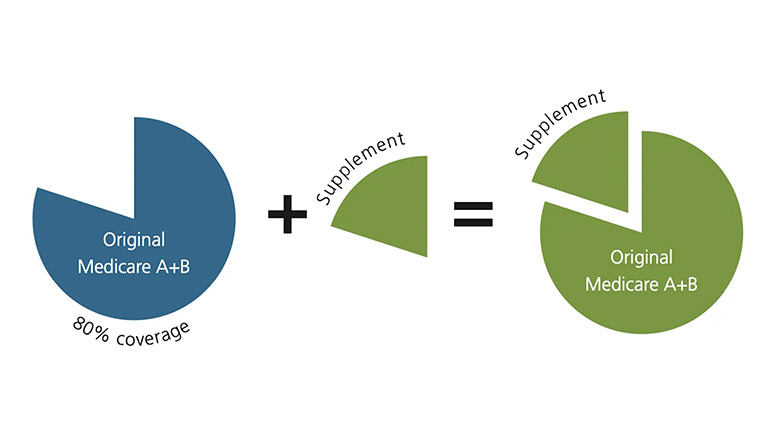

On its own, Original Medicare covers approximately 80% of a beneficiary’s medical services costs for Medicare approved services. There is no out-of-pocket maximum on the remaining 20%. Many enrollees are uncomfortable with this risk and choose to take an additional step beyond carrying Original Medicare.

A quick summary:

- Medicare supplement plans are private insurance plans that work in tandem with Orginial Medicare to fill in the gaps not covered by Medicare

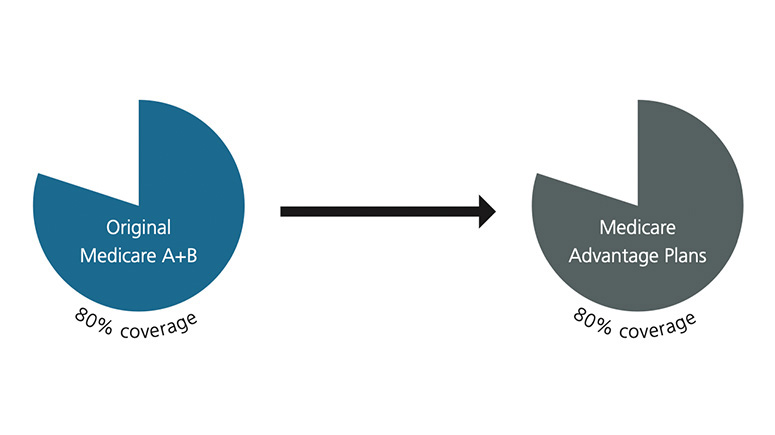

- Medicare Advantage replaces the original Medicare and is provided by private insurance companies that are required to cover the equivalent of what original Medicare covers – 80%.

- Medicare Supplement Insurance plans can be used anywhere in the US that accepts Medicare, offering patients the ability to choose their doctor.

- Medicare Advantage plans work with preapproved networks of providers, which can change at any time.

Explore two main options comparison at the bottom of this article.

Things to keep in mind:

- Costs and your budget: Health insurance costs encompass more than just monthly premiums. When comparing options, you should also factor in coinsurance, copays, deductibles, out-of- network expenses, and out-of- pocket maximums.

- Medicare Supplement Insurance plans offer greater predictability, with fixed amounts that can be planned for. In contrast, Medicare Advantage expenses can fluctuate more, depending on individual health status and incurred costs.

- Medicare Advantage (MA) plans generally have lower premiums. However, the medical coverage is also less. By law, these plans are only required to provide the same coverage as Original Medicare (around 80% of overall healthcare costs). Out-of-pocket costs related to coinsurance, copays and deductibles are generally higher than with Original Medicare and a supplement plan.

- MA plans pose a higher risk of incurring increased expenses compared to Medicare Supplement plans in the event of developing a serious or chronic

health condition.The Part B premium is paid by the individual whether they choose a supplement plan or Medicare Advantage (MA).

- Coverage needs: The option you choose when first enrolling in Medicare can act as your coverage for the remainder of your life. It is important to consider the

coverage you want at ages 65, 75, and beyond. While future health care needs are hard to predict, it is likely that they will change as you age. It is important to choose a plan that will provide the coverage you need when the unexpected happens.- Medicare Supplement Insurance covers doctor visits, lab tests, hospital stays, rehabilitation, and even hospice care, with few out- of-pocket costs. While MA plans cover similar services, they typically do not fill in the remaining 20% gap in medical service costs.

- With Medicare Supplement Insurance, you know what you are getting – supplement plans are regulated to provide specific, standardized benefits and do not change annually. You cannot lose benefits due to health needs or plan usage.

- With an MA plan, your coverage could change annually. MA plans are allowed to add or drop benefits and restructure costs each year.

- Choice and convenience: With Original Medicare and a Medicare Supplement plan, you maintain standardized benefits that were developed specifically with seniors in mind. MA plans are similar to private group and individual health plans.

- Original Medicare is portable throughout the country. Because Medicare Supplement Insurance plans work in tandem with Original Medicare, they are not subject to networks. Instead, you can go to any provider or hospital that accepts Medicare.

- MA plans are managed care plans that require you to use a preapproved network of providers and hospitals. Some MA plans are Preferred Provider Organizations, which allow you to use out-of-network providers for additional costs.

- Original Medicare and Medicare Supplemental Insurance generally provide straightforward access to care with minimal referral and prior authorization requirements.

- MA plans utilize referrals and prior authorizations, which may mean you cannot access certain care if they deem it unnecessary.

What's the difference? The four C's

| Difference | Medicare Supplement | Medicare Advantage |

|---|---|---|

| Coverage | Supplements Original Medicare | Only "equivalent to" Orginal Medicare (80% coverage) |

| Cost | Additional monthly premium | Continue to pay Part B premium |

| Convenience | No networks, referrals, or prior authorizations. Portable. | Managed care plans |

| Choice | Ability to choose your doctor and healthcare facility | Must choose in-network doctors and facilities to avoid even higher costs |

*Plan N pays 100% of the costs of Part B services, except an office visit copay of up to $20, and emergency room copay of up to $50”

Educating yourself today can benefit you greatly in the future.

- Medicare enrollees begin with Medicare Parts A and B; Also known as Original Medicare or Traditional Medicare.

- Part A is free for most people while Part B has a base cost of $185 per month in 2025.

- On its own, Original Medicare covers approximately 80% of a beneficiary’s medical services costs for Medicare- approved services. There is no out-of-pocket maximum on the remaining 20%.

- Many enrollees are uncomfortable with this risk and choose to take an additional step beyond carrying Original Medicare.

Can I change my mind?

- When you first enroll in Medicare Part B, there is a six-month window of time in which you cannot be denied enrollment in any available Medicare Supplement Insurance plan.

- Once you are enrolled in a Medicare Supplement Insurance plan, it is guaranteed renewable and cannot be canceled, except in the case of non-payment.

- Outside of the six-month window, a Medicare beneficiary would need to pass a health assessment (underwriting) to enroll in a Medicare Supplement plan. This is true if the beneficiary is attempting to switch from one Medicare Supplement Insurance plan to another, switch from one insurance company to another, or switch from an MA plan back to Original Medicare and a supplement plan.

- In general, the goal should be to pick a plan that you are confident in as your health coverage for the remainder of your life.

- MA plans are required to allow Medicare beneficiaries to enroll in their plans during designated enrollment periods throughout the year.

- Anyone who enrolls in an MA plan for the first time is granted a trial right, during which they have 12 months to decide if they would like to stay in an MA plan or return to Original Medicare and a Medicare Supplement Insurance plan. In this circumstance, an enrollee would not be required to pass a health assessment.